Insights & Opinions

Top 3 threats for banks today (my takeaways from Money20/20)

Wed, 12 Jun 2019

Last week I represented The Banking Scene at Money20/20 Europe. I skipped one year, so my last edition was in Copenhagen. Man… this conference has grown. The coffee I took at the entrance, was almost cold when I finally reached Mainstage.

To my surprise, their growth was for me personally the biggest eye-opener of this edition. The conference is the place to be for networking and for meeting everyone in the industry of financial services and money. In terms of content, it seems like the industry is looking for a new technology to create some buzz.

That is why I decided to give this post-conference article another twist. Based on all the input from the conference, and my personal insights, I decided to talk about the banks’ 3 biggest threats for the future.

No, legacy is not number 1!

Threat number 1: Ego

I’m not saying all banks keep struggling with their ego, there are exceptions. It remains striking what some keep saying on stage though. The ones who understand that banking is no longer a one-man-show do have a chance to survive the next 10 years.

Take Tinkoff, who started as a mono-product card company in the past. Banks didn’t worry, because they only provided cards. 6 years ago they started diversifying to a full-fledged financial services provider. Today they provide banking and insurance products, investments, ticketing and travel services… That is when banks should get scared, not only because they become a serious threat, but also because they have another business model, based on fee revenues instead of margins. It is like… future-proof!

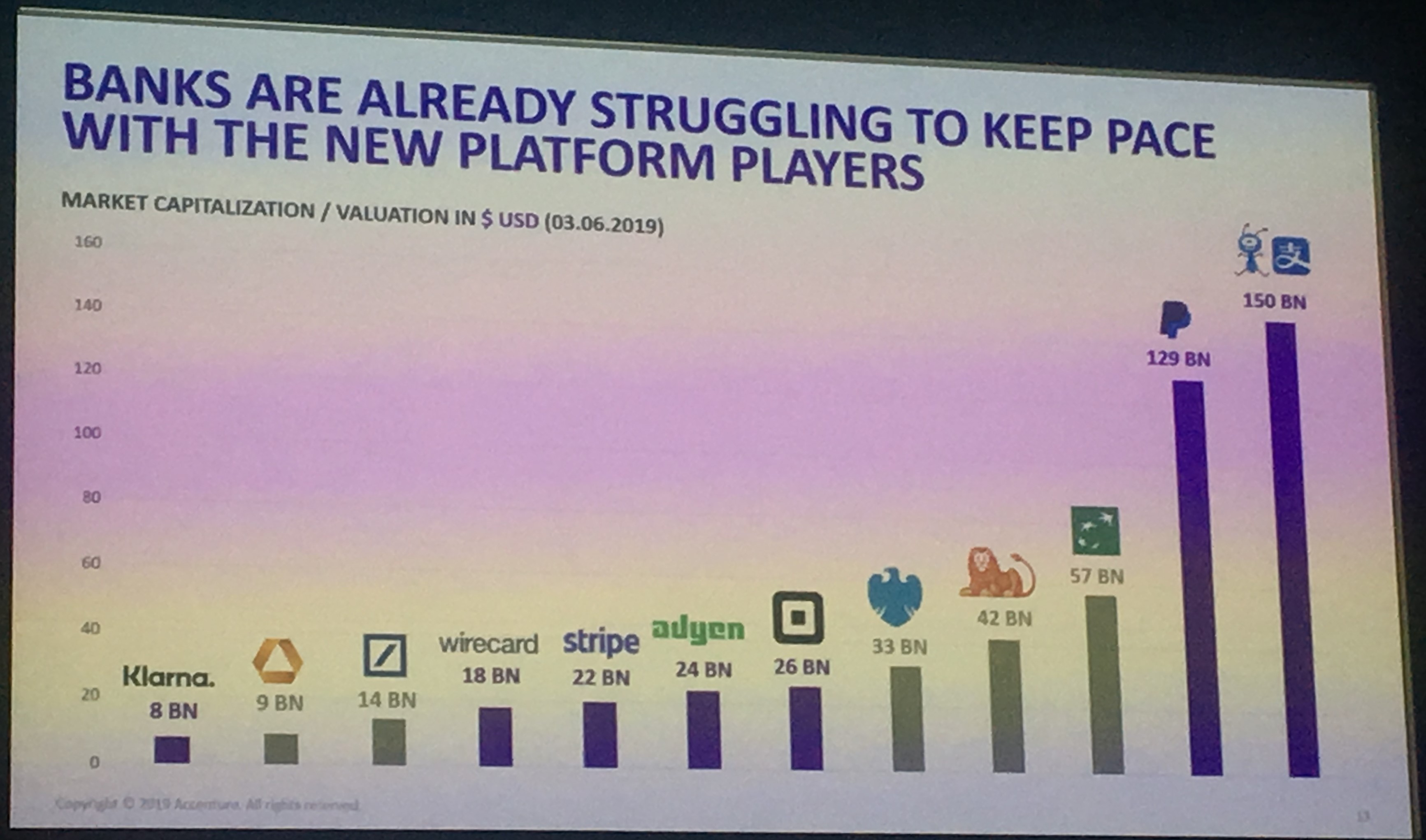

Ralph Hamers, CEO of ING, was on stage as well. His talk showed me that ING starts to understand the change in the industry as well. I only had a tough time digesting his statement “we want to be the platform”. My message here is: everyone wants to be the platform, but a bank that is future-proof will also, and maybe even more so, be able to easily connect with other platforms. Platforms are taking over from banks in terms of market power, just look at this graph by Hakan Eroglu of Accenture:

After all: customers go where the added value is, not where the money is… Money is just a means to an end.

To come back to Ralph Hamers: he acknowledged their compliance issues and ING learned from that to better manage their risks, not only in terms of data security, data privacy and IT security, but also compliance risks and perhaps even more importantly: societal risk!

Societal risk a key element here. It is the kind of risk that is very hard to manage with technology only, it requires human creativity.

Are you as a bank a good gatekeeper for societal access to financial services? It means you put yourself in service of society: how can you do this on a profitable basis?

There were others as well, like I mentioned in the beginning of this chapter. If I hear a banker saying “we are already a challenger bank, at least in market share”, I get annoyed. That clearly shows he did not understands what is at stake. Making this kind of statements is even worse than saying “every bank is a fintech”. Claiming you are a challenger because of market share hurts my ears, and it is an embarrassment the incumbent you work for.

Threat number 2: Talent

Everyone is looking for talent these days. Alexander Weber, director of International Expansion at N26 made this very clear: to become “the first global retail bank”, they are massively hiring new talent: from September 2018 to May 2019 they doubled their staff. That is impressive, not so much because they hired 500 people in 8 months, but because they are fishing in the same pool with all the other technology companies and yet they found 500 people.

Today every company is becoming a tech company and the labour market is shrinking. Having a financial background today is no longer enough, you also need an understanding of technology, and if you can code, even better!

With all these hot young companies all around us, how will banks be able to attract the talent they need to keep up with the expectations of customers and society?

That is to me a key concern, which may force banks to put their ego aside and to collaborate even more with fintech players, not only because of technology but also because of human resources.

I guess here you have one more argument to promote gender equality! Technology was mainly a man-thing. That is changing today. With the support of brilliant initiatives like EWPN, gender equality is pushed in the industry. This initiative is first and foremost an effort to help to provide services and product that are gender-balanced, through a conscious strategy that focuses on equal opportunities and a balanced workforce. Another side effect is that it will also enlarge the talent pool for financial services and technology.

More on the gender issue later in another blog 😉.

Threat number 3: Legacy

There was an interesting panel on “Building a bank from licensing to user experience”. Most of the debate was on a way banks should do business. I do like Jason Bates saying: “there is no business case for re-platforming, so incumbents continue building on to of. This results in an even bigger spaghetti. Challengers can start from scratch at only a fraction of the cost.”

That is very true.

Today banks are building on top of something that was built for purposes in another era.

They build connections with their core and they forget to sufficiently generalise the core, to make it flexible enough for scale. That same core was once built for a local market, with a local regulatory and fiscal environment.

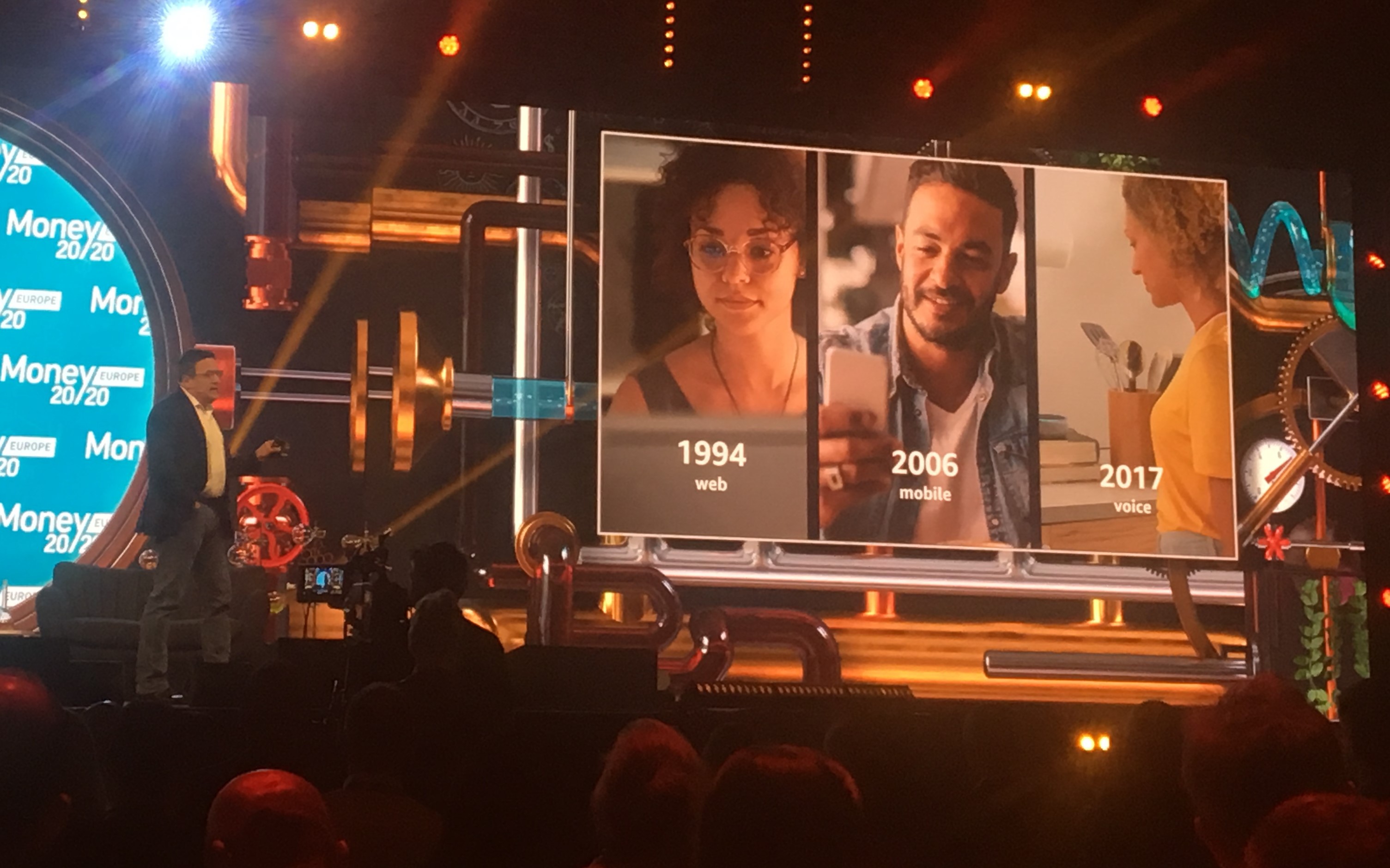

Patrick Gauthier, General Manager at Amazon Pay, visualised this nicely. He just forgot to add branches, the era when most of the core was developed:

Scaling with only APIs is no longer enough, unless you keep playing local. Even then: how can you keep up with competition if you focus on a local market, in a race to the bottom in terms of pricing to standard bank products? Indeed, you need to find another purpose of being, and find sufficient value so the customer is willing to pay more for it compared to the big scale platforms.

Jason Bates again: “It is not just a matter of starting to work on an agile way, it requires a complete change of the operating model including regulatory change etc… Therefor it is better to start a new bank separate from the main brand, from a technology and operating model point of view.”

I agree. For me, legacy is not only about legacy technology, but also about legacy thinking. Take for example the statement of Rajesh Venkatesh, Chief Product Officer, InstaREM, saying: “most of the money is coming from credit and lending products at banks today. But in a sharing economy the need to buy is disappearing, and how will this influence the future of credit and lending? What happens if people no longer see the value of buying a card or a house?”

Another good one by Jason Bates, Co-Founder at 11:FS: “because we move from the regular banking model based on margins to a banking model based on premium-fremium, commissions and fees, you go from strategy to Strategy: it al gets more complicated and tricky to find the right balance for a successful model, but a sustainable one.”

Money 20/20 2020

For next year, I believe Dr Herman Hauser (Director Amadeus Capital Partners) and Ralph Simon (CEO Mobilium Global) already shared a bit of detail on what the next buzz in tech may be: quantum computing. Although a lot can be said on quantum, the experiments are still very premature.

This can change quickly though! Their prediction is that by 2023, that is in 4 years, in portfolio management, quantum may already be used by some on a day-to-day basis! If you know that with quantum computing, all our current security measures will be as simple to read as code, the impact is huge!

Quantum computing will further accelerate the evolution in technology. I like to quote Ralph Simon once again, to give you an idea: “Quantum computing is about exponential growth, whereas normal computing is lineair”.

Please put more on this on the agenda next year!

In the coming weeks I will also be sharing a couple of interviews here on Open Banking, with a few key players in the industry. Please follow me if you like to be among the first to read them!