Insights & Opinions

The story behind the numbers: open banking investments and returns

Tue, 16 Jun 2020

June 11 was a good day! Jan van Vonno, Research Director at Tink was our special guest at The Banking Scene Afterwork to answer all the questions I had on their recent study, titled: ‘the investments and returns of open banking’. This survey bundled the opinions and insights of 290 financial services executives from 12 European countries on the topic.

This study shows to me that open banking today is on top of every financial institution’s agenda.

With only 1,4% of respondents that do not expect a return on investment, banks start seeing the opportunities. The market adopted the concept of open banking incredibly fast and the mindset matured in a short timeframe.

COVID-19 increases open banking spending

The world changed at a head-spinning rate between the data gathering for the research and the publication.

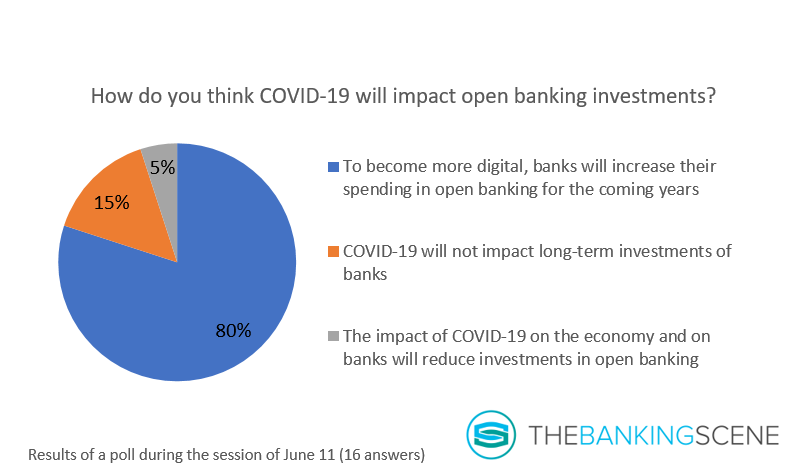

So we started our Afterwork session by asking the webinar attendees how they think the virus will impact investments in open banking. 80% of the respondents believed that the virus would increase investments in banking.

This result resonates with the many discussions that Jan had with executives during the crisis, no infection on the budgets there. Changing demands to more digital banking may even speed up certain investments. Even more: banks that do need to cut in costs will rather reallocate budgets to open banking to answer changing demand by their customers.

Median open banking spending between €50 million and €100 million

By asking both IT and business how much they spend and how this is distributed across the organisation, Tink got a complete overview of where open banking has the most significant impact. Pure IT costs represented 28%, followed by Product costs (25%), Compliance and Risk (24%) and Operations (23%).

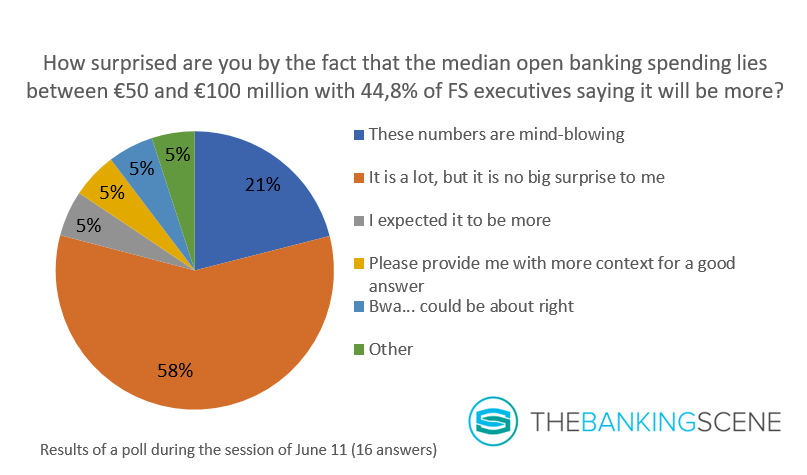

That explains the high median open banking spending in Europe between €50 and €100 million, with 44,8% of financial services executives saying it will be more. Talking about averages was impossible, as the questions were on an ordinal scale. Needless to say, big international players budgeted a lot more than local smaller players.

During the Afterwork webinar, 60% of the attendees indicated that they were not surprised by these numbers.

Open banking and data-driven finance are more today than just a buzzword: it evolved to an integral element in a bank’s digital transformation strategy. Now it is time to fulfil its expectations to the whole wide world.

17% of respondents will spend €1 million or less

The scope of the survey was ‘regulated financial institutions’: a mix of international retail banks, local savings banks, investment banks… leading to very different answers when talking about open banking investments.

Respondents that budget 1€ million or less in open banking are mainly these savings and investment banks, organisations that have no direct impact by PSD2. They lack maturity in open banking but are investigating the opportunities.

With 5500 registered banks within the EU, according to EBF, the industry remains very fragmented in Europe. Open banking will increase competition across borders. The same is true for savings banks: today, they can look for funding across borders, and open banking will help them to accelerate the internationalisation of these institutions and create a single digital market as proposed by the European Commission.

These niche financial institutions look at use cases, journeys, and new markets, like pulling in more data from retail banks to improve investments and savings recommendations for their customers. Open banking is not engrained in the digital transformation roadmap yet.

Some nationalities spend more than others

Portugal, Germany and France are the biggest spenders, for various reasons.

Multi-banking has been around for many years. This is now part of the open banking movement. It was focused mainly on corporate banking. Many ERP systems have direct connections with banks. Treasury departments have been using open banking, or multi-banking, capabilities for many years.

Countries with experience in this field show a higher willingness to spend as if they understand better what is at stake. Portugal, for example, has MB WAY, retail multi-banking scheme with 1 million users connected to the app since its launch in 2014. Like Isabel in Belgium, the main shareholders are Portuguese banks. Consumers are charged a fee for every credit transfer they initiate in the app.

This model is at risk now. The lower cost of coding and the regulatory standards create a comfortable environment for banks to experiment. For the first time, they start making their own investments instead of purely building common market platforms.

Portugal is not just one of the highest spenders; they have the highest expectations as well, with 60% of financial services executives saying this will be less than four years (European average is 50%).

They outsource the compliance aspects, those elements that are not differentiating and they emphasise on what brings value, where they find a clear business case.

The German and French market have other reasons why they spend more than average in open banking. Incumbents in these markets have been grown through M&A, and open banking stimulates them to streamline their infrastructure. According to Jan, they need massive reorganisations to profit from open banking from an operating model perspective. All this is not embedded in the open banking programs.

Countries like Belgium are not that high on the list, but they did indicate to be spending more in the future, with 71,4% of Belgian respondents in the survey stating that the budgets for open banking were growing in 2019. This is the second-highest number (after the UK).

Number 2 driver to invest in open banking: IT modernisation

Two obvious drivers for open banking in the top-3 are customer experience and process optimisation. Of course, innovation in open banking will create more value for the customer. I also understand that process optimisation, improved productivity and the resulting reduced costs is another principal driver.

Number 2 was IT modernisation, which I always interpreted as a prerequisite, rather than a driving force for open banking. Jan explains that many IT modernisation projects were on the roadmap for years. They are now being pushed forward and hooked on open banking as an excuse to make these investments:

- Using APIs externally and internally will help institutions to reduce costs by recycling code

- Compliant APIs means they need to provide it according to the standard the regulator expects from them.

IT modernisation will help banks with this in the long term.

Banks spend millions in PSD2 and open banking, and they expect a return from this. Financial institutions need to adopt and embrace open banking as a TPP. Commercialising additional data also requires consent to use this data. You can’t just start marketing, upselling bank solutions by mining new data without your customers’ approval.

There are still many unknowns in open banking among banking executives. As an organisation and as an infrastructure provider, data driven finance is completely new to them. It is no longer enough to be a provider to APIs; you also need to be a contender, a consumer of third-party APIs to provide value to your customers.

Companies like Tink work together with financial institutions to make sure also these APIs reach the necessary maturity to scale on a European level.

So yes, now I understand IT modernisation is on the list.

A mature open banking strategy: concrete cost savings and customer delight

API development and API thinking are the first steps in the process to open banking. A mature open banking strategy will look further, though.

Tink helps banks to discover the endless opportunities of open banking, not just towards customer experience and cross-selling opportunities but also the less visible process automation and improved onboarding possibilities. Many use cases play on all these axes at the same time.

Take credit checks, for example. The business case is clearly in the productivity enhancements: by automating part of the customer due diligence process, you reduce the time spent on reviewing forms and correction errors. That way, you accelerate process cycle times with cost reductions as a direct result. The increased sales by improving customer experience is a nice extra.

Another one: the example of a client that is using open banking tech for their onboarding. Customer conversion increased by 150% after the bank enabled new customers to authenticate themselves via a competitor in the registration process. They cut out the manual forms and unintended manual errors in the process. The reduced friction in the process had a direct impact on the churn levels.

Again: the concrete benefits are cost reductions, and the extras are higher customer acquisitions and increased sales.

As you can see, classical KPIs also apply for open banking projects. Jan: “what I would typically say for a C-level executive is to create a scorecard that captures customer, business, operational and risk KPIs. Think Net Promoter Score, engagement scores, or satisfaction scores; think revenue, requests, churn; think productivity, cash flow, costs saved, and think capital risk, security risk, credit risk.”

Jan spoke with a board member from a large European bank recently. Their strategy for their PFM project is based on a number of milestones, resulting in a different KPIs per milestone:

- MAU threshold

- referral threshold

- revenue threshold.

Once the service hits an X number of MAUs, they will start to measure success on referrals for up and cross-sell activities, once this becomes profitable, they will aim to generate direct revenues through in-app services. This is what some people like to call the type of Silicon Valley business model. The value increases as more people use it, and after it is scaled once it provides clear value.

Why SMEs are less impacted by open banking and why this will change soon

Most cases today are consumer-oriented. The scale and the ability to test different scenarios were two key reasons for that, to find TPPs to test these different scenarios as well. That is more difficult in an SME world, where businesses focus on their business. They don’t trust TPPs that much, and they are more reluctant to test new ways of banking without a concrete return on providing their data.

SME banking will embrace open banking soon. Credit scoring is a big opportunity for disruption in open banking, and businesses need a lot of credits, in many forms.

Jan: “On the long term and the biggest opportunity from a total addressable market is absolutely in the business space. The things that you can start thinking about is invoice management, treasury, ability to improve trade finance, the ability to do automated credit checks…”

They are more willing to take a risk; they have a higher willingness to pay if it brings value to the business.

Conclusion

I’ve written a lot about open banking in the last 12 months, and I saw how the importance of the topic grew, with more Open Banking Interviews, I got higher executives on my list. This Afterwork session showed me once again that so many professionals are still in the discovery phase.

Open banking spendings demonstrate a healthy appetite for the topic. I think it is also symbolic for the learning curve in front of us. To make open banking a success, we need to remain sceptical and look at banking differently. Banks shouldn’t blindly jump on any opportunity, and they need to look at complete value chains to calculate what value open banking use cases can bring to them.

Interestingly, chances are high you will find the value in cost reductions instead of in revenues generators. This will make discussions with your executive board easier: you will not be discussing the assumptions you make for higher revenues, but you can list the concrete costs you will reduce.