Insights & Opinions

The Future of Banking: Platform Economies and The Road to Reinvention

Tue, 21 Jun 2022

Paolo Sironi is the Global Research Leader in Banking and Financial Markets for IBM Consulting, Institute for Business Value - a Global Think Tank for discussions about the transformation of the Financial Services Industry. He is also the co-host of Breaking Banks Europe (part of the Breaking Banks family), the no.1 Fintech podcast worldwide. We were fortunate enough to have him join us for a roundtable on the 16th June to share insights from his latest book

But first a bit more background for those of you who might immediately think of Paolo as “the IBM guy” if you have seen him on stage in the past.

Paolo likened his professional journey to date to Dante’s Divine Comedy (being Italian, he has a natural flair for the dramatic). He explains that he started his career as a risk manager in the “hell” of banking, where he encountered many “sins” that most of us are not even aware of. He later moved to Germany and built a startup innovating in digital wealth management, which he considered to be his time in “purgatory”, a time that was painful and full of mistakes but at the same time was very enriching. IBM bought his startup in 2013, which is when he entered the ”heaven” of Artificial Intelligence and Exponential Technologies and the opportunities these provide to create value for humans – the space he now spends most of his time in.

He travels the world extensively, talking to startups, FinTech, entrepreneurs, regulators, bankers and people in technology in order to understand how to transform financial services for the better, beyond simply throwing technology at the problem.

He mentally divides the world into 3 macro regions:

- USA (specifically Silicon Valley), where much technology and fintech are born

- EU, where most of the regulation is born and

- Asia Pacific (specifically China and India), whom he considers to be the real winners of the FinTech revolution where business models are born

His role within IBM for the last 10 years has been to review business models and understand how technology can scale these within the relevant regulatory frameworks across the world. His core focus is not disruption but rather sustained innovation to transform the Financial Services industry in a fairer way while avoiding collapse.

As Paolo’s latest book is all about Platforms and Ecosystems, we dived straight into the topic of why he thinks they are the key strategy that banks and fintech should be pursuing right now.

Paolo explained that most banks and financial institutions today are neither platforms nor ecosystems, but rather linear value chains. He drew parallels with the automotive industry and their process of manufacturing a car. The car is comprised of multiple different parts from multiple different suppliers, but ultimately, they are packaged into a standard product that the consumer can lightly customise with accessories. The customer is completely shielded from the complexity of the process and ends up with a car – the output of the process.

Historically, financial institutions have operated in the same way. The customer is oblivious to the complexity of fund management or regulation required to “manufacture” the products they are offered in the form of mortgages, loans, investments etc. The customer sits at the end of the value chain and simply consumes the output.

According to Paolo, the world is shifting to “outcome” based economies where the consumers are less focused on products and more on outcomes, values and how these fit into their lives.

The automotive industry has already begun to embrace this shift by building car-sharing platforms and developing ecosystems based around outcomes. The customers no longer have to buy the output of the linear value chain. They can instead pay for an “outcome” in the form of getting from A to B or getting the use of a different type of car for different use cases as and when they need them.

The automotive industry has had to rethink its business model completely, and its entire ecosystem has had to be expanded as a result. They now rely on partners, for example, location-based services, city mapping, parking spaces, electric charging points, local authorities and many others, all of whom have a role to play in increasing and enabling the value of the ecosystem to be unlocked and to provide positive outcomes for the customers.

Paolo believes that to meet customer expectations, financial institutions must stop focusing on outputs (products) and more on outcomes (value) for their clients.

If you truly want to help your customers achieve their personal or business financial goals, you have to shift your strategy from selling a single product at a time and understand how their needs change over time, what their different use cases are and how you could leverage an ecosystem to help them achieve the outcomes they desire.

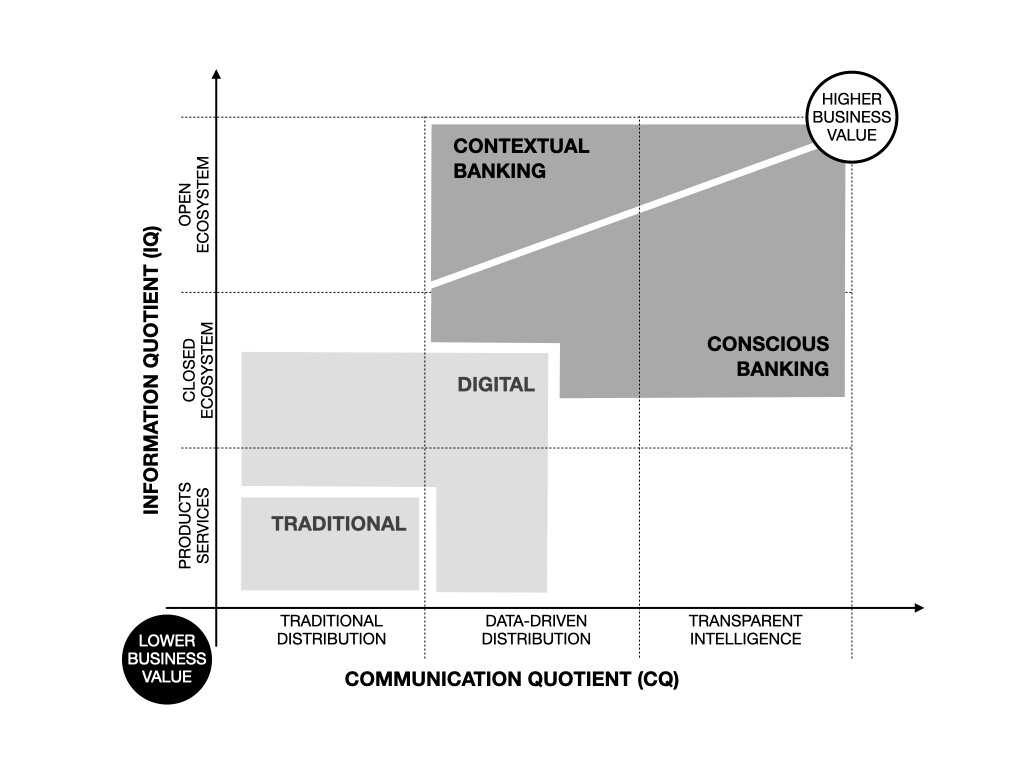

The key to winning in this new economy, according to Paolo, is to invest heavily in increasing your Information Quotient (IQ) and Communication Quotient (CQ), as depicted in his Banking Reinvention Quadrant (BRQ), which is introduced in his book.

The Information Quotient axis is essentially the technology axis, reflecting how you use data, technology and insights to eliminate friction and embed services into adjacent industries. The Communication Quotient is the business axis and reflects how you use AI and data to support humans and decision-making.

Paolo describes “Contextual Banking” platform strategies as those based on Banking-as-a-Services (BaaS) architectures and open banking data and insights to be consumed by external ecosystems, while “Conscious Banking” strategies are those based on Banking-as-a-Platform (BaaP) architectures and open banking integration with external bank and non-banking offers to increase the value for clients.

This is, of course, an extremely simplified explanation of the BRQ, and I’m afraid you really will have to read Paolo’s book for the detail to unlock the secrets that could shape your future strategy.

Interestingly, one of the audience members in the roundtable had not only heard about the BRQ before this session, but their company had actively started to work on applying it to their business. They had come to the roundtable specifically to ask Paolo how to overcome an obstacle they had already encountered:

“How can you make the shift from an output-centric organisation to an outcome-centric organisation when all existing incentives are product focussed?”.

The answer, of course, is that you have to change the business model, which will, in turn, determine how incentives need to be structured, which in turn will drive new behaviours that are outcome focused.

Paolo is not under any illusion that transformation will be easy, but in his opinion, it could be very rewarding for those that are willing to undertake the journey. As he told his co-hosts of the Breaking Banks podcast many years ago:

“You cannot break banks, for the simple reason that banks are already broken.”