Insights & Opinions

Sustainability Matters in Your Payments Strategy - Measures to Consider

Mon, 04 Sep 2023

Some time ago, I had an enjoyable lunch with a payment executive. We spoke briefly about the challenge of translating a bank’s sustainability goals and strategy in the payments department. Until recently, I didn’t put much belief in the possibility of reducing the carbon footprint of payments in the banking industry, except for further digitalisation to avoid transport to branches and paper exchange.

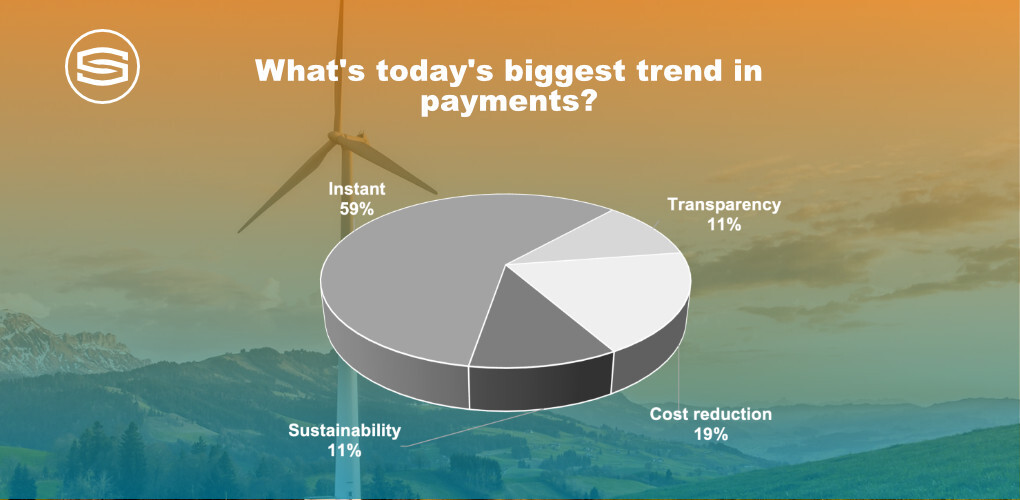

Because I was curious, I asked Innovation In Payments, our LinkedIn Group, for support, with a first poll asking what is currently the biggest trend in payments. The number of options to give in such polls is limited, so I selected four holistic ones as a conversation starter. If needed, people could share another option in the comments. These were the options:

- Sustainability;

- Instant;

- Transparency;

- Cost reduction.

Three days later, 333 people voted, and Figure 1 shows the results:

Result of Innovation in Payments Poll, August 2023, with 333 responses

Result of Innovation in Payments Poll, August 2023, with 333 responses

The winners are the more obvious topics: instant payments and cost reduction. 11% voted transparency, and another 11% voted sustainability, indicating it may be necessary, but don’t expect sustainability on top of the list in most organisations.

Sustainable Payments are More Cost-Effective Payments

Aside from the few valuable comments on product development, one comment stood out in this blog's context. This person said: “I think cost reduction and sustainability go hand in hand”.

That is a comment that gets people’s attention. Cost reduction and sustainability go hand in hand. So, if we create a more sustainable payments factory, we reduce our cost structure, leaving the organisation with a healthier and more competitive payment processing.

How do we get there?

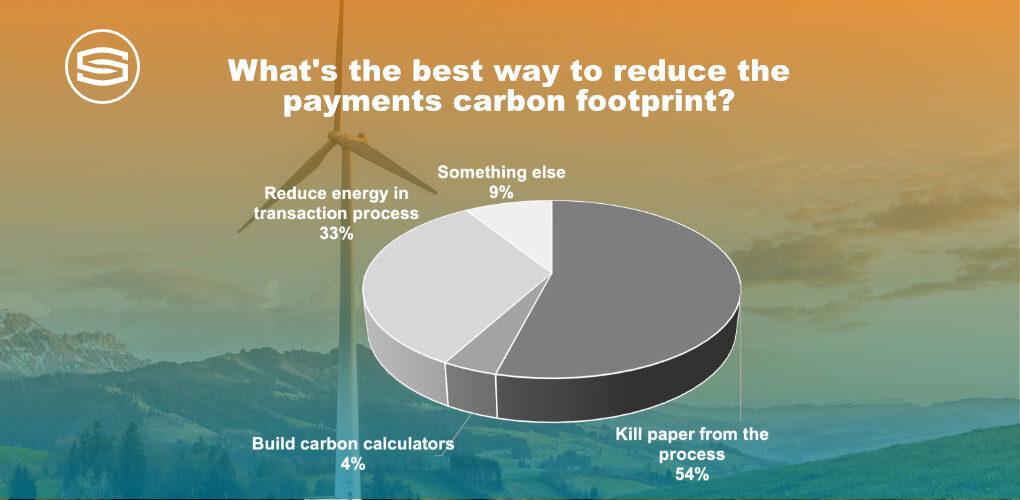

A week later, I launched another poll focusing on sustainability in payments. I asked the 75k Innovation in Payments Community how best to reduce the payments’ carbon footprint. These were the options:

- Kill paper from the process;

- Build carbon calculators;

- Reduce energy in the transaction process;

- Something else.

After 129 votes, we came to the following result:

Result of Innovation in Payments Poll, August 2023, with 129 responses

Result of Innovation in Payments Poll, August 2023, with 129 responses

Carbon calculators are clearly not the preferred choice (4%). Perhaps that is because I shouldn’t have added it since it doesn’t affect the payment process as such, but, in the best case, it improves consumer consumption instead.

The clear winner is to kill paper from the process. Killing paper in the process is all about digitalisation. Although that requires IT, is it still business in the lead to provide the requirements for how to change processes.

Given the high degree of electronic payments, on top of the electronic processing of paper transfers and cheques, for example, reducing the energy in the transaction process got 33% of the votes, and rightfully so.

The Business Objective That Became an IT Challenge

That brings me to what is likely the biggest challenge for financial institutions that wish to reduce the carbon footprint of their payment rails: it is often a business objective but an IT challenge.

There lies an enormous opportunity in the way the payments factory is structured. The fact that transactions are screened by every party involved in the payment chain will affect the carbon footprint. So , in this respect, collaboration across organisations could be helpful in reducing the carbon footprint of a payment. Avoiding double processing is a no-brainer as a measure to sustainable payments.

More importantly are those measures that are in full control of an organisation. Some of the measures suggested by ChatGPT included: carbon offsets, remote work, paperless offices, a sustainable supply chain, employee education, user education and eco-friendly packaging.

All that is true, but essentially comes down to more digital payments, more digital work, and offsetting carbon for the remaining energy consumption.

The real challenge lies in reducing the energy consumption of digital processes. For example, some data centers will be more energy efficient than others, for example. What is your provider doing in that respect? Are they organised in an energy-efficient way? Do they use renewable energy to power their data centers? Bear in mind that 0,3% of global CO2 emissions is data-center-related, according to the International Energy Agency.

More technical and also more interesting is something called Green Coding. IBM defines Green Coding as: “an environmentally sustainable computing practice that seeks to minimize the energy involved in processing lines of code and, in turn, help organizations reduce overall energy consumption.”

When people speak about spaghetti banking, it is because coding has been built over the years on top of coding, and developers in the past didn’t really think too much about how to streamline all that because the priorities were delivery. Of course, the slimmer the coding and the fewer lines of code are required, the less computing power the system requires.

There is more. IBM found that next to accelerated progress towards sustainability goals, there is also a reduced energy cost. Surprisingly, IBM even found that implementing sustainability and digital transformation initiatives, such as Green Coding, report a higher operating margin than their peers.

On the long term, cleaner coding also builds a culture of better development discipline.

That also explains why Microsoft launched, for example, the “Green Software Foundation” in partnership with Accenture, Thoughtworks, Linux Foundation and GitHub. Their ambition? To help the IT sector reduce 45% of its greenhouse gas emissions by 45% before 2023 by creating new standards and practices for carbon-friendly coding and building green software.

So yes: cost reduction and sustainability go hand in hand, but it requires business and IT also walk hand in hand towards that greener future.

So no: sustainability in payments should not be an idealistic ambition but a driver for change with an immediate positive impact on the organisation.

If you are currently working in the payments industry, there is some good news for you. It is highly likely that your IT department is already addressing some of the topics mentioned earlier.

By the way, if you have any additional insights or experiences related to this topic, we would love to hear from you. Please feel free to share your thoughts with us. We are always eager to learn more.