Insights & Opinions

Microlending at The Heart of Local Entrepreneurship

Mon, 22 Jun 2020

On June 18, I was blown away by the engagement of a few big corporate institutions that put their strengths together to help microStart in supporting micro-entrepreneurs. For many entrepreneurs, microlending is vital to the required financial inclusion to set up a business. I didn’t know that.

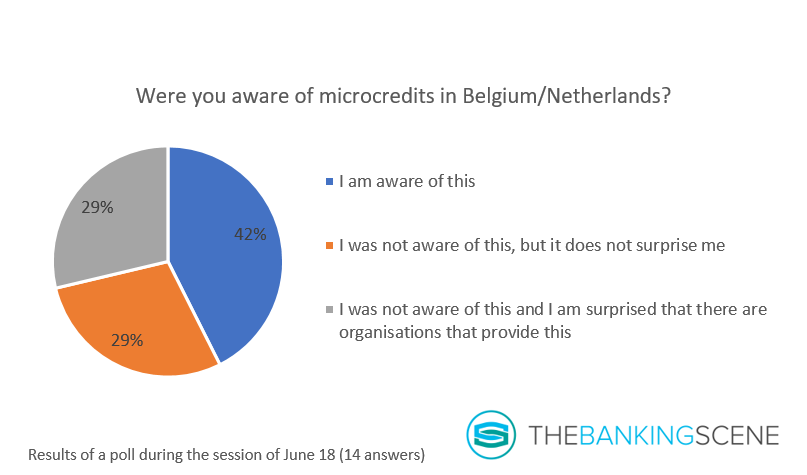

Call me naïve or poorly informed, but I thought that microcredits were something from less developed countries. A poll in this session showed that I am not the only one: 58% answered they were not aware of this business.

That is a significant number, knowing that most of the respondents work in the financial services industry.

Three special guests joined us around the virtual table during the Afterwork session of June 18. Each of them looks at microlending with another lens and support it with their key capabilities.

Our three guests were:

- Emmanuel Legras: CEO of microStart

- Adrien Kirschfink: Board of Directors of microStart and Managing Director at Accenture

- Daniel Thielemans: President at Accenture and Advisor to the CEO of BNP Paribas Fortis

This session was an eye-opener for me, and I hope that this blog will open the eyes of many many more people.

What are microcredits? Why are they so important in Belgium?

The start of the microfinance movement in Europe goes back to the end of the ’90s. Over the years, it grew to a European Microfinance Network, which federates more than 140 microfinance institutions.

Today, still too many companies suffer from limited access to funding or even regular access to financial services. The goal of these microfinance institutions is to increase financial inclusion.

The website of the European Commission states that “The European Progress Microfinance Facility (Progress Microfinance) was launched in 2010 to increase the availability of microcredit — loans below € 25 000 — for setting up or developing a small business. Our support for microfinance is now being implemented through our EaSI programme.

The EaSI programme does not directly finance entrepreneurs, but enables selected microcredit providers in the EU to increase lending, by issuing guarantees, thereby sharing the providers’ potential risk of loss. In addition, the European Commission is providing support for building the capacity of selected microcredit providers.”

microStart is such a microcredit provider: they provide loans in combination with management support in the form of coaching, training etc.… The combination of financing and coaching is the secret to more financial inclusion and sustainable new businesses.

microStart gives trust, opportunities, but also responsibilities. Emmanuel Legras, CEO: “entrepreneurs are taking a risk by starting a business. They are borrowing money, and they must repay those loans, so don’t consider us a charity. We give these entrepreneurs a responsibility”.

Daniel Thielemans, President: “A microloan of €5.000 can change the life of multiple people.” They create a network effect where entrepreneurs ignite others to more creativity and exponential employment, as these entrepreneurs need more employees to help the company grow.

microStart evaluates the success by a couple of KPIs (key success factor) that measure their IMPACT on society:

- The number of people they supported

- The number of created jobs

- Sustainability rate of the business they are financing

The social impact is a lot more than the economic impact and profitability of the company, which is currently not a priority yet.

Purposeful banking behind the scenes

For close to 10 years now, BNP Paribas Fortis is part of microStart, as one of the founding fathers.

Daniel Thielemans explains: “The bank supports the 17 sustainable development goals of the UN, with a focus on the environment, social and governance. BNP Paribas Fortis wants to have an impact on making sure people have jobs and can take care of themselves. We did an analysis and found out that we would have more impact if we worked with an independent organisation specialised in microfinance, instead of doing this ourselves. Doing it through our traditional channels was not the right way. As a result, we became the majority shareholder of microStart.”

The magic of microcredits is the symbiosis of financial support and coaching and training to guide the beneficiaries in spending the money well. It is in the latter that banks would likely fall short.

Adrien Kirschfinck, Managing Director at Accenture: “Are banks willing to invest time in coaching and support and can they motivate their employees here to go the extra mile? As a microfinance institution, you have the network of volunteers, the right culture and drive to facilitate advisory services.”

In the mindset of ecosystem thinking and collaboration, it is Adrien’s conviction that not everyone should not do everything themselves. Collaboration could be a much more fruitful way of supporting the microcredit business as a bank.

Adrien: “Let companies like microStart do what they are great at and let banks support it by doing what they are great at. This balance will lead to much better results.

If someone enters the branch or contacts the bank for a loan and that customer does not have a required credit score, you will create a lot more impact by giving him a solution. Bring this person in contact with microStart instead of simply sending him home. The person will remember the gesture, and who knows, perhaps he comes back when he is ready for the full bank relationship at a later stage.”

BNP Paribas is a shareholder, a lender and a source of volunteers that help microStart and their customers: of the 150 volunteers, about 70% are ex-employees of the bank. As the main shareholders, they also provide multiple executives for advisory services and positions in the Board. This way, they contribute to the business, making sure they grow according to the business plan, in a professional manner and by keeping the risks under control.

Purposeful consulting behind the scenes

Accenture has committed on a global level to a program called ‘Skills to Succeed’, with the ambition to equip the same amount of people as the number of employees they have worldwide (500.000) with the skills to either create their own job or to find a job in the market.

Today, Accenture already equipped 3 million people, six times more than their initial ambitions. Supporting microStart was a way to contribute to this in Belgium.

They assisted microStart both with the strategy development and implementation and in their coaching and training activities for staff and customers. They finetuned the business plan to double the volumes in the next three years, by keeping the cost base equal.

There is more in this partnership than fulfilling the global KPI of the ‘Skills to Succeed’ program. In the various projects at microStart, their employees gain experience in a very collaborative and multicultural environment which is entirely different than the traditional Accenture client.

These consultants are involved in the 60 different projects to realise the strategic goals. They feel what it is like to be purposeful, to make a life-changing difference, which translates back to their day-to-day life. The cross-fertilisation between bank business and microfinance business, the different cultures, enriches their consultants, both on a personal and on a professional manner.

Digitalisation is essential to more efficiency and higher reach

The spirit of microStart is that the social purpose comes first, the business purpose later. 60%-70% of the yearly budget still depends on public and private subsidies, and capital increases.

The profitability of not an objective at this stage but a higher efficiency sure is. The investments today are focused on a reduced cost structure, improved communication channels and better customer support. These investments must sustain and balance the budget, according to the business plan.

The lower ticket size of the credits and the higher exception handling in the credit scoring, make the personnel cost considerably higher compared to the lending business of a bank. Process automation will help to increase the quality of their services as well as making the organisation resilient when volumes would go up, without the need for additional hires.

Over the last few months, microStart employees answered about 4.000 calls related to the crisis, mostly standard questions that could have been responded digitally. They are now setting up a chatbot to solve this kind of questions instantly, 24/7/365 and without volume constraints.

Emmanuel: “60% of our clients were born abroad, and more than 30% are migrants and refugees. 40% of demands today are through our website registration form. They use social media to stay in touch with the world, so we reach out to them through these digital channels. Digital communication to promote microfinance is key.”

A new website, better access to social media and increased digital communication are the cornerstones to reach more people.

No significant impact of COVID-19 today, but that is a matter of time.

A study by microStart and Accenture in April revealed that 69% of micro-entrepreneurs are extremely worried to survive the coming six weeks because of COVID-19. Luckily today, thanks to the anticipation by the government to support local entrepreneurs, most of these entrepreneurs remain active.

It is uncertain how this will evolve in the coming months and years. In a past Afterwork session, with Brad van Leeuwen, we learned that a new generation of entrepreneurs is rising, and COVID-19 will only accelerate this process.

Better risk management is very high on microStart’s priority list right now, just like making sure they can deal with higher demand for credits in the near future.

Daniel: “Banks are big aircraft carriers, where organisations like microStart are little boats with a 15-horsepower engine. In the COVID-19 crisis, it was interesting to see how different these two players reacted to the crisis. The banks anticipate to all the governmental and regional initiatives for mortgages, delayed reimbursements, and loans to SMEs. microStart quickly came with a 3-step plan to assist its customers.”

They got in touch with public and private organisations for sponsoring and quickly found the required funds to kickstart this campaign. They did not wait for someone else to come up with suggestions but took it in their hands to provide a solution to their customer.

microStart has been through an incredible process over the last few years, and they are better prepared than ever to cope with a crisis of this size. Right now, they have the right tools in place to better serve their customers and to deal with higher volumes.

More partners for financial inclusion

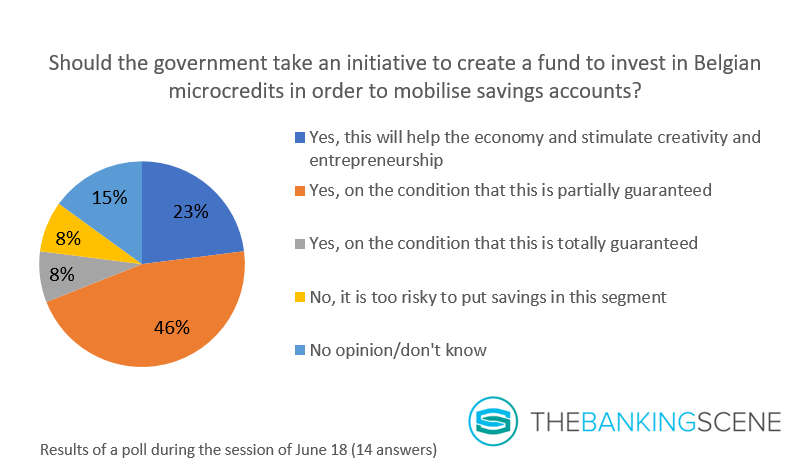

We asked the audience what they thought of the idea for the government to create a fund to invest in Belgian microcredits to mobile savings. There was a clear consensus that this could be a good idea, with the majority saying that state guarantee is a condition to make it successful.

A government initiative is just one way to grow the funding of the microfinance sector. Overall, more awareness will be required: by making people familiar with microlending, they will also be more supportive, and that will lead to more partnerships and who know… to more buy-in from the government to investigate an initiative like creating a fund to mobilise savings account.

The last surveys show that despite the crisis, more people want to set up a business. The future of microfinance will be digital, to improve its services and accessibility and to allow the volunteers to be more on the field with their clients for business support, coaching and training.

Daniel Thielemans: “Partena and AG Insurance are partners of us, a few investment funds, but the door is always open to all financial institutions, whether that is as a shareholder or as a lender. We love to have more friends around the table to help us develop microStart in Belgium.” Partena is even opening their offices for microStart to help them grow the physical footprint.

Conclusion

For me, this session of June 18 was extremely revealing. Hearing executives like Adrien and Daniel explain the bigger purpose in supporting microStart and hearing Emmanuel sharing these personal stories of how they are changing lives had a significant impact on me.

I hope that some of you had a similar experience during the session, or that by reading this article you’d like to know more about them and have a talk to see how you, or your organisation, can help in supporting the microfinance business. That can be by volunteering, funding or even becoming a shareholder.

And if you do: let me know, I’d love to hear how you improved financial inclusion.