Insights & Opinions

How to turn PSD2 into a remedy to recover from COVID-19

Tue, 02 Mar 2021

How to turn PSD2 into a remedy to recover from COVID-19 was last week’s challenge of The Banking Scene Afterwork, February 11. In a highly interactive session, in collaboration with YTS and their expert Bas van Marisssing, we learned that the levers that go with PSD2 could absolutely help businesses and consumers in trouble.

We also learned that this isn’t a simple black or white story. For optimal solutions, the banking industry will need to make more efforts to streamline interpretations and grow open banking possibilities.

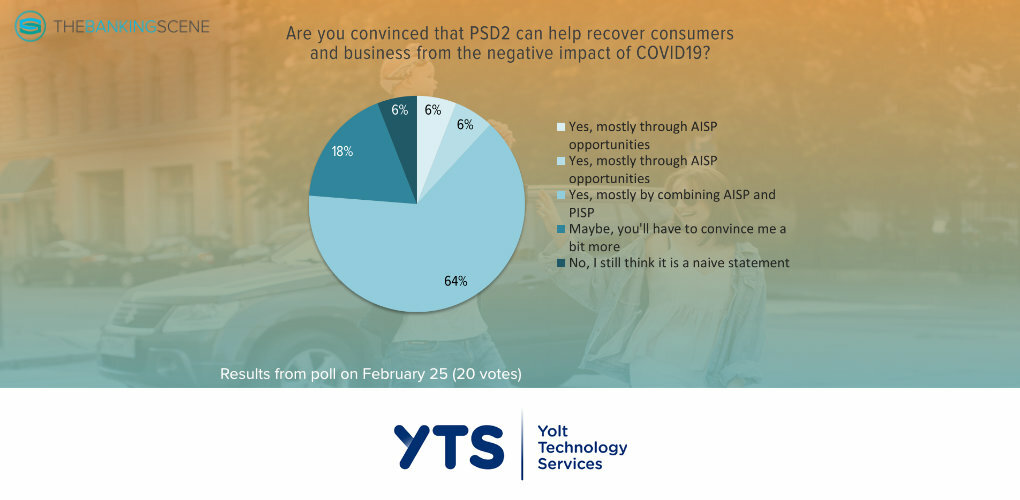

Nevertheless, by the end of the session, most attendees (76%) were positive about PSD2 as a remedy to recover from COVID-19, compared to 29% at the start. It will be interesting which new solutions enter the market in the coming months or years.

Better insights = higher resilience

What is the first thing people and business in trouble should do to recover from a financial headache? They need to create transparency in their finances, and if possible, they need a partner that can help with the right insights to evaluate how to do better.

AISPs, Account Information Services Providers can help. Integrating the opportunities of PSD2 in ERP systems may not be entirely new to most Belgian businesses, but it is in many other European countries. Replacing CSV files and MT940 messages by API calls will reduce manual labour and human errors.

The cost reduction of this kind of optimisations is not even the primary argument to replace file and message transmission by API calls. Higher data integrity automatically improves data analytics insights, leading to better steering mechanisms for the organisation, improved cash management, and sometimes even new revenues, as we learned in another session on automation in banking.

In situations like the COVID-19 crisis, access to lending solutions can already be enough to overcome short-term liquidity problems. The opportunities of AIS are changing the way financial services look at credit scoring, according to Bas. Simple rule-based principles are being replaced by analysing concrete spending patterns that a customer has at various financial institutions.

Whether this leads to better loan conditions or a smaller loan for the client, it will always be in favour of that client’s financial situation, according to Bas: “Because if the client cannot afford more, you don’t want to put them into a dangerous financial situation. Having that insight is of the highest importance.” Add to that, if the loan gets approved, a feast reception of the required cash for the client, and you quickly understand how PSD2 can help recover from COVID-19 in this respect.

In the UK, some challenger banks even issued government support almost instantly, thanks to AIS.

In the same sphere, Bas shared that YTS set up a collaboration with Graydon: “This is a joint proposition where we combine the data from Graydon with PSD2 data, which is a low, easy, accessible solution. So that will be used by fuel card providers, for instance.” Fuel card providers depend for their creditworthiness on their client’s creditworthiness. The transparency provided by AIS can optimise all this.

Lower cost = faster recovery

When revenues are under pressure, take action at the cost side of your business. PISP, Payment Initiation Service Providers can help streamline the financial processes and offer cheaper alternatives to existing payment solutions.

A couple of participants in the session pointed at FX and international trade finance as potential use case for small and medium-sized companies. PIS allows banks and fintech companies to reduce the cost of FX rates for customers with real-time currencies exchanges. Customers transfer the money on a local IBAN, and the exchange happens on internal accounts of the bank or fintech, and, at the other end, they execute it as it were a local payment again.

Another area is e-commerce, where PIS services have the potential to replace cards in the value chain. Where card payments mostly come with a variable fee for the merchant, the fee structure of PIS is fixed. Bas observes that often for amounts starting at €40-€50, PIS becomes cheaper to use than cards.

In a recent white paper on data security in open banking, YTS argues that PIS can be seen as more secure than cards as a payment solution. “PIS is more secure. Usually, with your cards, you leave credentials at the retailer or the merchant or the provider of the service,” Bas explained. “With PIS, it will be entirely based on bank security. You don’t have any credentials that are left behind in the user flow. Cybercrime is maybe the most significant threat for our economy, so making sure that your credentials are not out there in the open is very important.”

Add to that the instant transfer of the money on the merchant account and the irreversibility of the sums paid, and you wonder whether all this is enough to create a valid alternative for cards with a 70-year history of rulebooks, agreements and back-office support to merchants.

The right value proposition has, indeed, the potential to disrupt the e-commerce market. Bas: “A good example is what we see happening in the Netherlands, where we have iDeal, which was sort of PIS in disguise, and so I believe the PIS is the same as what iDeal was. You see that now 70% of online payments in the Netherlands is done through iDeal.”

They are not alone, just look at what Payconiq is achieving these days. Like iDeal, it is not running on the PSD2 APIs, but it applies the same principles.

Payment finality = lower financial stress

PIS are irreversible. Bas explained that big billers, like energy suppliers, are very interested in that element: “What I see is that PIS is now also being used, especially by the bigger corporates, to have an alternative to direct debit, for instance. They first do a direct debit. If the direct debit fails, they can offer a PIS.”

When combining the irreversibility of PIS with the insights of one-time AIS call, big billers can calculate the right time to get in touch with the customers to ask for a payment in case the direct debit did not come through.

As most of the PIS are instant, businesses can make their shipping processes and trade finance activities more efficient, leading to better customer experience and improved cash management.

What’s next?

The EBA recently published an opinion to put pressure on NCAs (national competent authority) “to ensure banks remove any remaining obstacles that prevent third-party providers from accessing payment accounts, which restrict EU consumers’ choice of payment services”.

Only by creating a level playing field across the EU with a consistent application and supervision of all things related to PSD2, KYC, and RTS (regulatory technical standards), the industry can build uniform solutions to reduce the financial stress for both consumers and businesses.

Once every ASPS, Account Servicing Payment Services Provider, also known as banks, has a shared understanding of PSD2 and open banking, the focus of open banking will rebalance from compliance to collaboration, from required implementation to added value creation for the customers.

As open banking further matures, banks will grasp more value from it. Bas acknowledges that this kind of innovation is not always something customers expect from a bank: “The bank is always struggling with the balance between being trustworthy, safe, versus innovative and forward-thinking. I think that’s also the case with new business models in using PSD2 or open banking.” People expect new business models more easily from new players like fintech.

Looking further in the future, Bas is excited about new possibilities to keeps banks in the position of a trusted partner of financial data, while providing customer freedom and value by sharing this data, in restricted ways.

Bas: “In the future, I expect the possibility of restricted access for aggregators, perhaps stimulated by the banks. As a customer, you say you will give your bank account access to show only salary payments, rent, or other requests for very specific use cases. That will become common in the coming years.”

On top of that, he expects more data to be added in the AIS offering, like savings, investments, pension information etc., leading the industry to a more open finance ecosystem.

Conclusion

Can PSD2 help to recover consumers and businesses from the negative impact of COVID-19? At the end of the conversation, the audience was convinced that it can, but it will require new business models that combine both AIS and PIS.

Bas: “It won’t take long before AIS and PIS are standardised, even more common. The added value that we bring will be on topics like categorisation, credit scoring, and KYC, all services that we are offering to help banks, or fintechs, complying with these regulations.”