Insights & Opinions

How To Find The Open Banking Money Pot

Mon, 14 Sep 2020

What does it mean for a bank to be open? What value will it bring to this bank and its customers? How did the industry do thus far?

These were a few of the questions we discussed during last week’s Afterwork session, titled: “Unlock the Value of Open Banking”. This was also the subject line of a survey that YTS conducted in the UK and the Netherlands to better understand the perception of different industries towards open banking.

Leon Muis, Chief Business Officer at YTS, brought us the story behind the numbers in their report, the confusions and misconceptions that still exist around open banking and the vast opportunities resulting from this concept.

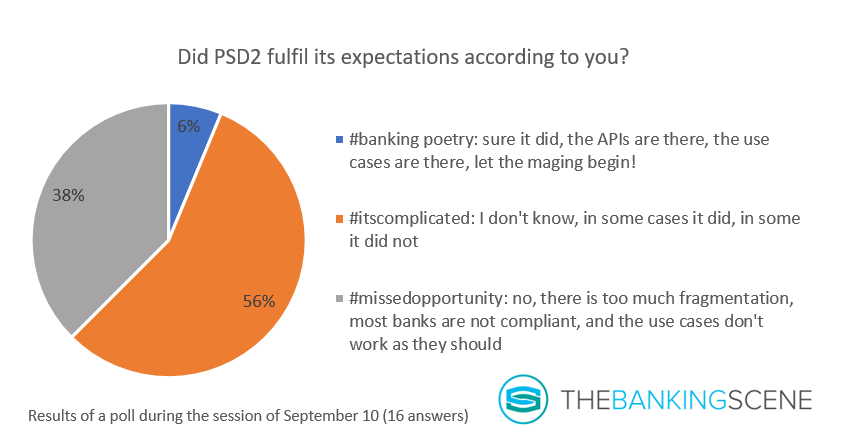

How did the banking industry do in terms of opening up the last 12 months? PSD2 was a complicated process, and the reason is both technological and cultural. When we asked our audience if PSD2 fulfilled its expectations, 67% said that it is more complicated than a simple yes or no.

Leon: “Yet I am convinced it is a step in the right direction. We need PSD2 as a kick-start to eventually open up a broader scope”.

Three reasons why the PSD2 open banking provisions have not taken off substantially

The main reason why open banking is not a success that some hoped for, is because it is acting against a bank’s nature. Banks have been closed institutions for centuries, they built on their strengths and developed a strong reputation in protecting data, not in sharing them, with their entire technology stack set up precisely for safeguarding this data.

Changing all this takes time.

Alignment and standardisation are another concern. Leon believes that essentially that is the reason why PSD2 is a missed opportunity. Europe has so many different API specifications, on a country level, on a platform level and even on a bank level.

Again: changing all this takes time.

A third important reason is the misunderstanding of open banking. The YTS study showed that 25% of the respondents defined open banking as “a legislation allowing any company to access an individual’s financial information, regardless of consent”.

If we want open banking to be successful, we must, as an industry, break the misconception that exists over open banking. The end-user must understand that open banking is not about compromising on privacy, but about getting more control over his/her data and being able to share that data with who he/she wants, not with anyone and not without consent. This requires action on an industry level.

If people do not trust open banking, how can we expect it to be successful after one year?

Reason number four: COVID-19?

50% of surveyed businesses used open banking functionalities before the health crisis and will keep doing so in the future. An additional 12% was looking at open banking and decided to speed up the developments because of COVID-19. These numbers resonate perfectly with the previous open banking session and the one on doing digital. So no, essentially COVID-19 is no delaying factor in most cases (except perhaps the SCA for cards implementation).

Without any doubt, the most prominent business challenge in 2020 is to recover from the COVID-19 crisis. YTS’s survey showed that a valuable second is to reduce transaction costs. In Leon’s opinion, these 2 challenges are linked: reducing transactions costs is one way to recover from COVID for organisations that find themselves in a cost-cutting exercise.

The open banking money pot: PIS (Payment Initiation Services)

For years, bankers are attending the one conference after the other to find the open banking honey pot… after years of listening, networking, developing, testing, finding the open banking gold remains challenging.

Transaction fees are a domain with incredible cost reduction opportunities. Especially for retailers, open banking has a clear financial advantage in credit-card-heavy countries. To give you an idea: in March 2020, 1,6 billion credit card transactions were registered in the UK, with roughly a 1% transaction fee. Imagine all that gets replaced by a near-zero transaction cost payment solution on the rails of PSD2, with real-time reconciliation.

Leon: “Open banking can power so many use cases across so many industries, from fashion and retailers to incumbent and challenger banks and even vending machine providers, to name a few.”

But are retailers willing to give up the insurance, loyalty and support of cards schemes, and the rulebooks that created the right trust environment for both retailer and consumer for so many years?

Today, they clearly did not grasp the £1,000,000 opportunity: the UK had 480 million API calls in July 2020, 0,2% being for payment initiation services. Delaying Strong Customer Authentication for card payments is probably one of the reasons, Leon says, and he hopes that soon, PIS services will catch up once there is a level playing field again.

The open banking money pot: AIS (Account Information Services)

So essentially open banking today is primarily used for account information. Leon sees a tremendous opportunity for lending providers. Open banking allows a lot more data sources, resulting in much more accurate credit decisions. With COVID-19, banks needed a adapt their approach towards credit scoring, because even a 3-year history of a customer does not say how financially healthy they are today.

By completely transforming the unstructured paper data transfers to structured, pure digital, data you allow automated (near-)instant credit assessments and loan decisions. It will not only reduce the operational cost of credit management but also improve the customer experience and sales.

My favourite conclusion in the report is that most of the value will not be generated by implementing open banking, but rather by reviewing the entire impacted process while implementing open banking.

Leon: “I hope that open banking can make banking more inclusive, that it helps businesses in need of money to get a loan, where they would not get one in the old situation. I hope that people in a bad financial situation can have a better financial life, with little steps, small loans and better consumption insights thanks to open banking.”

The testimonials of Yolt app users in the UK show that their PFM app makes life easier for some people. Suddenly consumers have the necessary transparency to avoid huge credit card interest fees or divorced people that still paid the Netflix bill of their spouse.

Increased transparency over spending is why, for example, ING Belgium connected Minna Technology: to help their customers in the subscription management. By adding additional data sources to support the customer in their day-to-day finance, they live up to the promise of open banking, and that is: helping customers better manage their finances in a secure way.

Can banks make money with open banking?

Banks are looking at each other to determine their next move. They catch up on the front runners, and today that is mostly aggregation services. Whether you are an incumbent or a challenger bank or even a platform player like the Yolt app: they all look at data gathering and trying to figure out how to enrich it for superior customer service.

Open banking will not generate substantial income for banks directly; they simply need to invest in it to stay in the market. TPPs may be willing to pay for some APIs, but they are not willing to spend a lot on it. In the next phase, with Open Finance in the UK and a European follow-up on PSD2, APIs will commoditise more, and banks will need to reflect even more on value-added services to earn any money with it.

Can banks charge their customers for open banking? According to Leon, customers want to pay if you provide the right service. One advice of Leon for banks that want to start charging extra services: make sure the value you provide to your customers is tangible: if you help them to manage subscriptions better, show how much they save with the extra service. If you have an open banking technology integration that allows the customer to find the best savings rate in the market, show how much more they can save.

Essentially you invest in open banking to streamline the process, to reduce costs and to improve customer service. People do not easily switch to another bank at this stage. However, Leon is convinced that if banks cannot come at, or above par of competition, these customers will sooner or later choose for the superior services. The life decisions like a mortgage loan will become less important, simply because the mortgage provider no longer has a monopoly over the customers’ bank data.

Challenges for a good open banking implementation

‘Data privacy’ and ‘finding the right partner for implementation’ are the two biggest concerns for organisations (banks and non-banks) to implement open banking, according to the YTS study. In today’s wild grow of international and national open banking service providers, it is hard to find the right partner for your organisation.

Leon: “What they deliver can vary a lot. Obviously, you have the basic ‘compliant’ solutions: PIS and AIS. Then there is a real value that you build on top of that. That is where we try to focus on by looking at the additional data enrichment opportunities.”

Open banking is a regulated financial activity. What is often forgotten is the whole KYC process, activity monitoring, anti-money laundering, etc. Banks are used to doing customer activity monitoring with internal data, but they get lost once external data is added to that. These are all challenges YTS can help with.

Next, there is the coverage that is different for each service provider. A bank with European reach prefers to work with one provider that has a continental range whereas local banks can have enough with smaller players with a local coverage (and lower cost).

Expertise and knowledge are a third important factor for service providers to differentiate. The industry is new, and even the big players like Tink and YTS need to build more awareness and street credibility to convince their prospects of the value they can bring.

All this requires a lot of dialogue and creative thinking together with the client. YTS has the unique advantage that they started with a consumer PFM app Yolt, an app that is hugely successful in the UK. They crossed the 1 billion API calls to open banking in the UK. The expertise in using these APIs is beneficial in those workshops. At the other end to the chain, they know the insights of the bank.

YTS is backed by ING. The required additional development times to adhere to the security standards of a bank, like double encryption on the AWS environment or a hardware security module to store the necessary certificates may sound like a disadvantage, but they understand the importance of data privacy. More importantly: the understand how to manage it according to the highest standards.

Conclusion

After all these years, open banking remains a mystery. The topic is inherently strategic, and yet, so many questions remain unanswered. This created incredible opportunities for some and serious risks for many others, in my opinion. Banks will need to leave their comfort zone, better sooner than later because the open banking revolution is flying full speed ahead.

Like Leon, I hope that open banking will make the industry more inclusive and that the industry will make open banking more transparent for all bank customers. The main challenges that YTS detected can be resolved with the right level of understanding of the concepts of, and players in, the world of open banking.

It is only a matter of time before these challenges are tackled, and from then on, banks can spend all their energy on finding the money pot of open banking and to make sure they can unlock its true value, which definitely exists, and will create colourful new experiences for both banks and their customers.