Insights & Opinions

Automation in Banking: reflections from the industry

Thu, 04 Mar 2021

On February 11, we held the third “Automation in Banking” session, this time with three experts from the industry that put automation into practice and many more attendees that work or plan to work on automation in banking. Part of The Banking Scene Afterwork experience is the polls that we issue to determine how the audience thinks about certain statements and questions. In this article, we’ll comment on the results of February 11, with valuable comments from our council of wise:

- Sidney Madison Prescott, VP Intelligent Automation at Spotify, co-author of “Robotic Process Automation using UiPath StudioX”

- Nicolas Gerard, Managing Director Product Management of State Street Bank

- Armand Angeli, Chairman of RPA, Intelligent Automation, Shared Services and Outsourcing at DFCG, the French Centre of CFOs

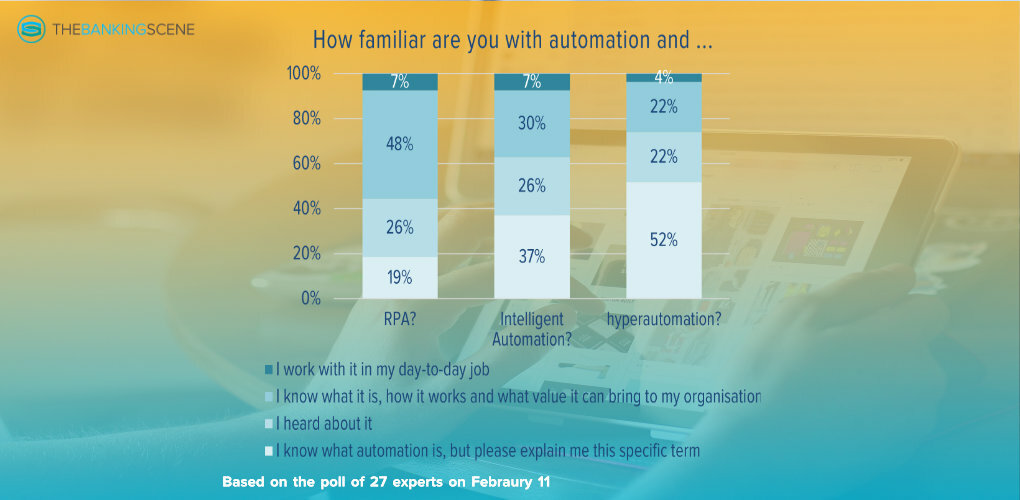

How familiar are you with automation?

“Everybody is talking about banking automation” was the introduction of the Automation in Banking sessions, and clearly, that is the case. However, while automation is perceived to play a central role in banks’ digital transformation efforts, specific terms like robotic process automation (RPA), Intelligent Automation, and hyperautomation are not always top of mind, polls show. The higher we move on the curve of sophistication, the bigger the confusion.

19% of the audience asked for an additional explication of RPA, which went up to 37% when we asked about Intelligent Automation and even 52% for hyperautomation.

How it works and what value it can bring to the organisation followed the opposite trend: 26% worked with hyperautomation or at least knew what it is and what value it can bring, vs 37% in the case of Intelligent Automation, up to 55% for RPA.

Sidney and Armand were not surprised. Automation is an iterative process, and organisations should start piece by piece. That is precisely what is happening today. RPA is best known because it is easiest to understand, with immediate and clear impact for the departments where it is rolled out.

In the last few years, awareness around RPA grew significantly, however: “Most companies, most banks have started with RPA, and as we can see here, not many of them are using RPA, all over the place.”, explained Armand. This may sound contradictory with the poll results, but it merely shows that RPA is often not part of company-wide projects in most banks.

Employees work with automated processes without truly understanding the technology because they don’t need to know. Many other employees who are not impacted by the processes are not aware of the benefits and organisation’s RPA programme, despite the added-value of a company-wide orchestration and coordination.

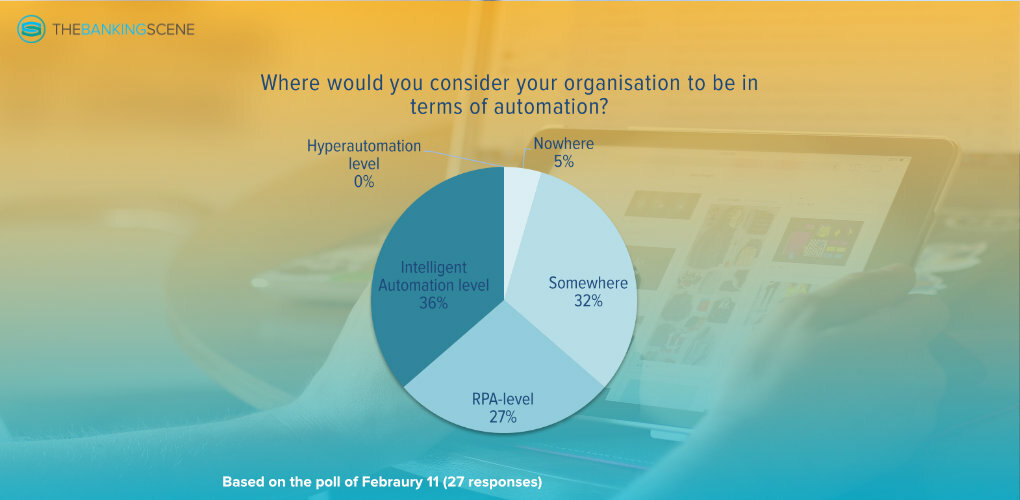

How mature is your organisation in terms of automation?

The level of sophistication of their organisation in terms of automation remains a grey zone for many professionals, with 32% saying they are ‘somewhere’ and not one person in the audience saying they are at hyperautomation level.

Part of the results can be derived from the fact that the audience was a mix of automation experts and automation enthusiasts. Enthusiasts are eager to know what the opportunities of automation are, they are keen to hear lessons learned, but they are not actively involved in automation projects.

Hyperautomation is getting much attention these days, but most organisations are still far off the optimal hyperautomated way of working.

The fact that there was no one saying their organisation reaches hyperautomation levels is not a surprise for Armand: “With hyperautomation, you are mixing RPA, chatbots, blockchain, IoT, all these things, and we are not there yet. We now have a toolbox, and we try to use tools of the platform.”

Sidney agreed that we should not put these different approaches into separate areas: “At the end, it’s just the integration of all of these available tools to produce this extremely intelligent, extremely efficient way of linking these processes together to create better outcomes, whether that’s data, whether that’s just overall process management. The challenge is that in most environments that I’ve seen, there are so many systems, there are so many ways of working, and it’s not very standardised across the different business units.”

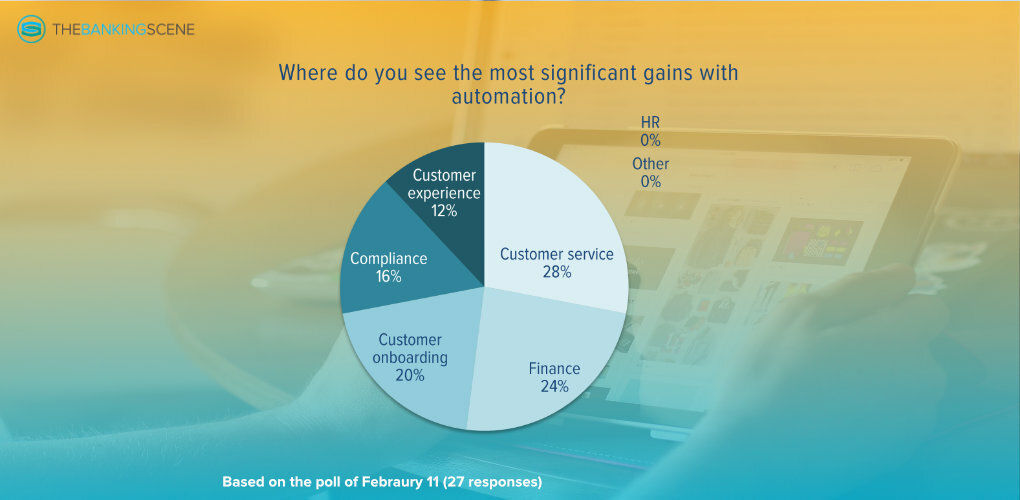

Who gains most from automating their processes?

Customer services, Finance and Customer Onboarding, are seen as the area where organisations have most to gain from automation, totalling 70% of the answers. Sidney was surprised to see that the compliance department dropped off the top-3.

“From my experience, I would combine compliance and finance as the most significant gains, followed by customer service,” Sidney said. “Because with the customer service piece, you’re going to have to add a chatbot experience potentially, you’re potentially going to have to add some sort of sentiment analysis. So it’s again, building out a complete tool stack, and RPA would be a piece of that. Whereas I think within finance and compliance, what we’re seeing is, it’s a bit easier to hit the ground running, primarily because the processes there are so manual, and they are very rules-based.”

In summary, she believes that with a small investment, the biggest gains are for the Finance and Compliance department.

Even with more investment, at the level of Intelligent Automation, she wouldn’t change her top-3, being Compliance, Finance and Customer Service: “A large amount of documentation and parsing of the data within that documentation that is done by humans today, unstructured data that we can basically extract either through out-of-the-box machine learning models, or create our own, and translate that language into something more readable for a bot to intake. So it’s, I think it’s the same wheelhouse, and you get the same opportunities.”

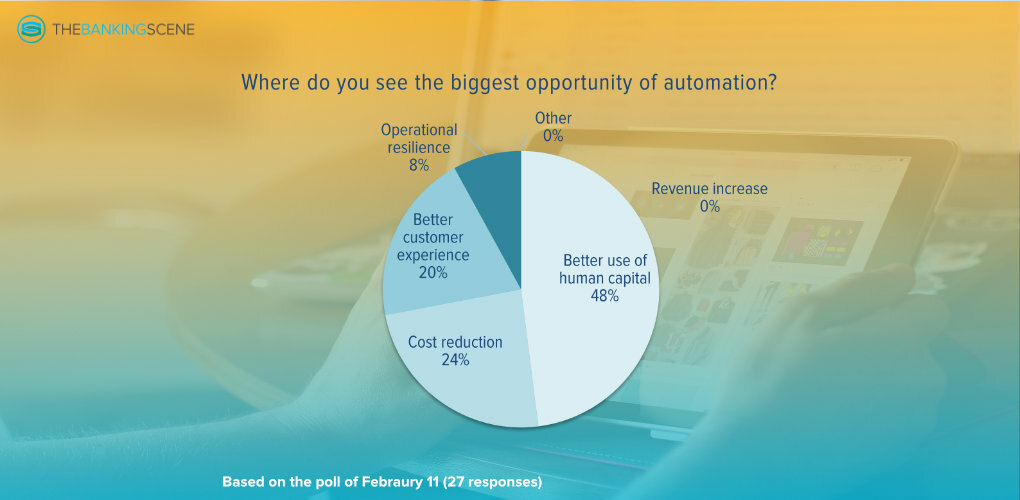

What is the biggest opportunity of automation?

In July 2020, we organised The Banking Scene Afterwork, dedicated to automation. In that session, only 7% listed “cost reduction” as the biggest opportunity. On February 11, 2021, this was 24%, which was good for a strong second position. The biggest opportunity was, just like in July 2020, “better use of human capital”, this time with 48% of experts voting this.

The experts agreed that “better use of human capital” is absolutely on top of the list in terms of opportunities of automation. Nicolas saw this at State Street: “the most significant opportunity is leveraging and maximising the value of the human capital, basically use leverage people’s brains instead of leveraging their hands. And make sure they focus on the value-added task.”

The three experts were surprised, though, that “revenue increase” was not voted. Each participant had only one vote. Yet, according to Armand: “by using all these new tools, you can do small things like looking at parsed data and deriving some new sources of revenue. You look at parsed data, for example, customers’ behaviour, and all these new things that you could not analyse before, but then you can explore because you can look at all of them.”

RPA and Intelligent Automation helped State Street to derive more insights from all the data that they have, which resulted in new products and services, and much more to come.

Conclusion

The first session of Automation in Banking was an absolute success. The experts showed what value automation could bring, which challenges they encountered in their automation journey and what the future will bring. The poll results also showed that Automation in Banking deserves more attention and awareness. It is by understanding automation inside out that banks can leverage the opportunities.

That is why, at The Banking Scene, we are excited that UiPath agreed to extend the partnership. Make sure you free your agenda on September 9th, when we welcome Chris Skinner, author and commentator at The Finanser and Nitin Purwar, Director Banking Industry Practice at UiPath to discuss "Automation for Good: Automation as an enabler for ESG and Sustainability in Banks."

If you cannot wait that long, we advise you to have a look at our website, where we share a guide on “Identifying the Real Business Value of RPA.”